Starting a business involves a number of vital actions, with consolidation being one of one of the most significant milestones for business owners seeking to develop an official business entity. One crucial item of this process is comprehending ‘What are Articles of Unification?’ and the crucial function they play in developing a company.

Filing this paper with the proper state authority not only develops your company as a legal entity yet additionally establishes the structure for its long-term procedure and reputation. This overview will stroll you through everything you require to learn about Articles of Unification, including their significance, benefits, submitting process, and following steps to make sure compliance.

What are Articles of Incorporation?

The Articles of Unification, likewise called a Certificate of Consolidation in some states, is a formal legal paper called for to create a company, laying out the important details called for to legitimately establish the business.Read about indiana articles of incorporation At website

To provide the articles of unification meaning, these records include crucial details such as the corporation’s name, purpose, signed up agent, and the number of shares accredited.

It serves as the structure for the firm’s lawful existence, offering important information regarding business structure and operations.

Articles of Unification significance

At its core, the Articles of Unification work as the ‘birth certification’ of a corporation. When filed with the state, this file formally develops the company, giving it lawful acknowledgment. Each state has its very own demands, however the Articles usually consist of details such as the corporation’s name, purpose, and registered agent details.

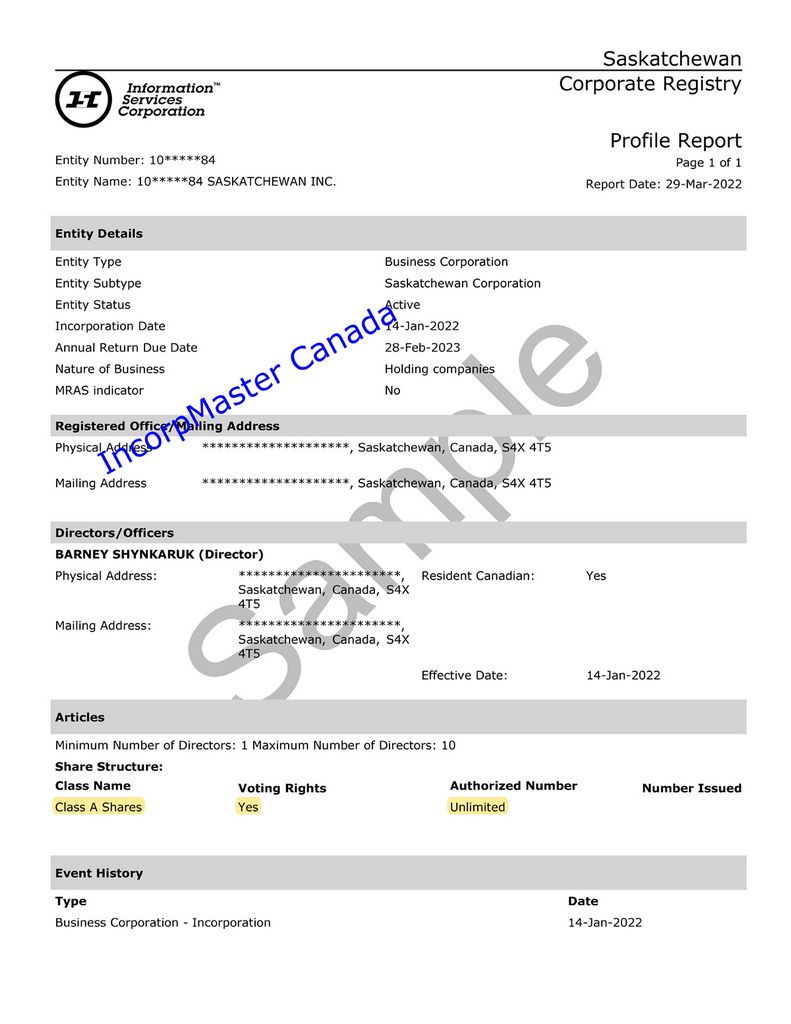

Example of Articles of Consolidation

Below is an example of Articles of Incorporation (likewise referred to as a Certification of Unification in Delaware), which addresses the inquiry ‘what do posts of unification resemble’ and is a file called for by the state to establish a firm.

This document is divided into six crucial areas:

- Call: Defines the official name of the company.

- Registered office and Registered representative: Checklists the address of the corporation’s registered office and the signed up agent accredited to obtain legal records.

- Function: Specifies the function or purposes of the company.

- Supply details: Information the authorized quantity of supply the corporation can provide.

- Incorporator details: Consists of the name and mailing address of the private in charge of filing the document.

- Signature: The undersigned area, where the incorporator formally authorizes the file.

Each section offers a critical function in lawfully defining the corporation’s presence and structure.

Benefits of filing Articles of Consolidation

Declaring Articles of Unification unlocks to numerous crucial benefits for your organization:

Personal property protection

One of the top factors entrepreneur include is to protect their personal assets. Declaring Articles of Unification develops a clear boundary in between your personal and company responsibilities.

If your corporation faces financial obligations or lawful problems, your personal effects, like your home or savings, usually stays safe. This protection is vital, especially in industries prone to dangers or lawsuits.

Unique legal rights to business name

When you incorporate, your business name is registered with the state, making sure that nothing else company in the same state can make use of the precise same name. This supplies a degree of exclusivity and secures your brand identification within that jurisdiction.

Nonetheless, it’s important to note that this protection is commonly limited to the state where you incorporate. If you desire more comprehensive defense, such as across the country exclusivity, you may need to register your business name as a hallmark with the united state Patent and Trademark Office (USPTO).

Prospective tax benefits

Although companies are taxed in different ways from sole proprietorships or collaborations, they can take advantage of certain tax obligation benefits. Depending on the structure (such as C corporation or S company), you could reduce overall tax obligation liability, keep earnings within business, or deduct expenses like employee benefits.

Enhanced organization reliability

An incorporated business carries even more weight in the eyes of consumers, suppliers, and financiers. The ‘Inc.’ or ‘Corp.’ at the end of your firm name signals stability, professionalism and reliability, and long-term dedication. This can assist draw in customers and strengthen your reputation in your sector.

Additionally, lots of companies and federal government entities favor to collaborate with bundled companies, opening doors to bigger contracts or collaborations.

What to include in the Article of Incorporation?

When preparing your Articles of Incorporation, below’s the vital details you’ll require to include:

- Firm’s name: The main lawful name of your company.

- Service objective: Either a general purpose or a specific one customized to your operations.

- Registered representative details: Name and resolve of the specific or entity authorized to get legal papers in behalf of your corporation.

- Preliminary directors: Names and addresses of the people who will certainly manage the corporation.

- Number and types of shares: The variety of shares the firm is accredited to issue and any kind of information concerning their courses.

- Period of the firm: Whether the firm is continuous or exists for a particular term.

- Business address: The primary workplace address of the firm.

- Sort of firm: For instance, C Company or S Firm.

- Assorted provisions (optional): Any added details pertinent to your corporate operations, such as investor rights or electing procedures.

How to prepare Articles of Incorporation?

As soon as you recognize ‘what is a post of incorporation’, you can start composing one for your service. Making use of a state-provided template can streamline the procedure and make certain every little thing is completed efficiently.

Action 1: Acquire your state’s template

The majority of states offer a standard Articles of Incorporation layout on their Secretary of State internet site.

To discover the template:

- Visit your state’s Secretary of State or business registration internet site.

- Look for ‘Articles of Consolidation’ forms.

- Download the correct layout for your firm kind (e.g., specialist firm, not-for-profit, and so on).

The layout will usually include fields or areas for standard information like your firm’s name, address, and the name of your registered representative.

Action 2: Add custom-made arrangements

Custom arrangements are optional, yet they can offer clarity and secure your organization interests down the line. Some personalized arrangements you may think about adding consist of:

- Ballot legal rights: Define the ballot civil liberties of shareholders, specifically if your company will certainly issue numerous classes of supply.

- Indemnification stipulation: Protect directors and officers from individual responsibility for corporate activities.

- Period stipulation: State the length of time you desire the company to exist, whether forever or for a details duration.

- Restrictions (if any type of): Consist of provisions that limit particular activities, such as limitations on transferring shares.

Step 3: Submit and submit your document

Once your theme is total and personalized, it’s time to file it. The majority of states permit you to submit Articles of Incorporation online, by mail, or in person.

- Pay the filing charge: Declaring costs vary by state but generally vary from $50 to $300.

- Maintain a copy: Maintain a duplicate of the finalized record for your records, as you’ll need it for jobs like opening up a service savings account or securing a Company Identification Number (EIN).

When and where to file Articles of Incorporation?

Recognizing when and where to submit, who is responsible for handling the process, and just how much it sets you back can make the process seem less frightening.

When to submit

The Articles of Incorporation are submitted throughout the initial phase of setting up a firm, right after selecting a service name, verifying its schedule, and picking a signed up agent to represent your firm.

It’s vital to file as quickly as you’re ready. Waiting as well long to submit can delay crucial next actions, like opening a business checking account or obtaining an Employer Identification Number (EIN) from the IRS.

Where to submit

Articles of Consolidation are submitted with the Secretary of State (or its equivalent) in the state where you intend to operate your corporation.

Each state has its very own workplace for business filings, which can generally be found on the state federal government’s site. Lots of states additionally offer on the internet filing solutions, making it quicker and more convenient to finish the process.

Who prepare and file the Articles of Incorporation

The person in charge of preparing and filing Articles of Consolidation is known as the ‘incorporator.’ This can be a business owner, a company rep, or anyone designated to handle the documents.

For included benefit and accuracy, you can get the assistance of a service lawyer or an online unification service. Trusted service providers like BBCIncorp concentrate on navigating state-specific needs and making certain error-free filings, whether you’re including in Delaware or discovering overseas territories.

Filing fees

The cost to submit Articles of Incorporation differs commonly by state, typically varying from $50 to $300. Added expenses might apply if you utilize an attorney or an on the internet service to prepare and file the papers.

Some states additionally charge a franchise tax obligation or call for an annual report after the initial filing, so it’s a good idea to allocate ongoing compliance costs.

What happens after filing Articles of Incorporation?

Filing Articles of Incorporation is a major milestone in forming your company, however it’s just the beginning of your service’s lawful and functional arrangement.

After your records are submitted, there are several essential actions to complete before your firm is fully functional and in compliance with state needs.

- Create laws: Laws help guarantee your company runs efficiently and stays certified with state laws. They’re additionally typically required by financial institutions or financiers throughout due persistance.

- Hold initial shareholder and director conferences: As soon as you have actually composed your corporate laws, it’s time to organize a conference to adopt business laws, designate policemans, and make initial choices.

- Obtain an EIN (Employer Identification Number): You can request an EIN online through the IRS site. Authorization is normally prompt, so you can begin utilizing your EIN immediately for tax and financial purposes.

- Secure company licenses or authorizations: Inspect if your business needs additional licenses to operate lawfully. and apply asap to avoid fines or hold-ups.

- Preserve conformity: Meet ongoing state demands like yearly filings or franchise business taxes.

Verdict

Preparing and filing Articles of Consolidation is an important action toward establishing a lawfully recognized company. These documents don’t simply guard your personal possessions; they aid your service stand apart with unique advantages like name exclusivity and boosted integrity.

If you’re still questioning, ‘What are Articles of Incorporation and why do I need them?’, remember that this foundational legal paper can drive your company toward development and success. When you prepare to take the leap, speak with sources like BBCIncorp to streamline the process, saving time and effort.